THE BANK, THE BRAND, AND THE CONTENT

How banks’ transformation is impeded with their content language

Gone are the days where the dominating classic notion of banks being perceived as a vacuum depleting business dynamics by reducing them into mere numbers. A more global banking outlook is already in place where banks are expected and actively involved in a “wider” societal and economic role. Banks’ brand identity plays a major role in reflecting the flexibility and adaptability of banks in an increasingly changing economic and financials scene, especially with COVID-19 pandemic still throwing punches at the whole system every now and then, testing banks’ resilience, resulting with an ever-growing credit crisis and increasing cost of risks for banks.

Reshaping the business model of banks is not only critical for banks, but a key cornerstone in adapting and reflecting the flexibility needed to remain competitive in the market (Accenture 2021). This important journey, which could lead to an increase of 4% in revenues (Accenture 2021), starts with understanding market dynamics and jumping on the digital transformation premiums by technological restructures. However, while these adaptations are necessary for a successful progressive journey, the foundation must be with a journey of self-discovery, creating identities starting with the self-image in the new reality of banks!

UAE Banks face the critical need of transformation to remain competitive

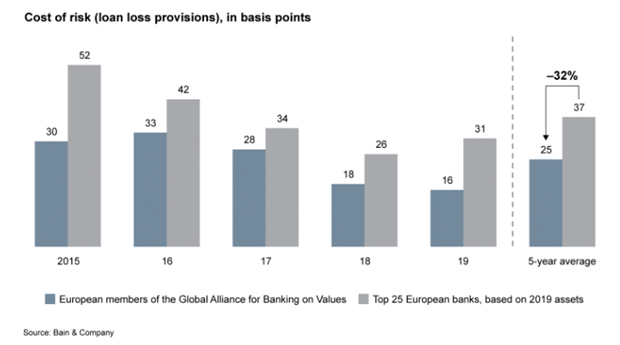

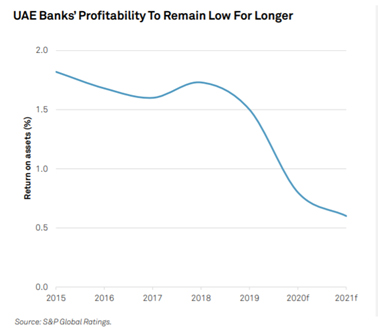

For many years, profit and purpose were, to a great interest, mutually exclusive in banking sector. With the current transformational era that we are in, a pushmi-pullyu situation is but a dead-end for banks. With the expected increase cost of risk and the fall of profitability next year (S&P 2021), one should not be surprised if UAE banks shifted gears towards profit in coming period. However, history showed us that slashing margins to increase returns could only result in high yield. On the contrary, the banks’ approach should be expanding market share by adapting and adopting ESG (Environmental, social, and governance) strategies and agenda, before it is too late. Banks’ social responsibility & inclusiveness are key for repositioning in market landscape. As many banks are after the growing market opportunities of ESG, it proves that it is not only placing themselves in a better sustainable position, but also reaping lows costs of risk as well (BAIN 2021)

PUSHMI-PULLYU: THE NEVERENDING STRUGGLE BETWEEN PROFIT AND PURPOSE

In the past years, UAE banks showed a steady increase and growth of assets, which were disrupted heavily by the pandemic. As the chart below shows, the growth in assets is almost static for the top 6 UAE banks.

With purpose taking the driving seat in this journey, we take a closer look at the top 2 banks in UAE: how they position, represent, and structure their identities in this critical period of time.

METHODOLOGY

Consult Upgrade’s team collected texts from the two aforementioned banks: social media and websites in order to measure and conduct text analysis and answer questions related to the positioning and placement of those two banks. With a corpus of more than 1.5 million words, the texts proved to present and provide a vast collection of signs and traits that are not what probably the banks had in mind. In addition to the traditional semantics analysis, personality traits, and the behaviour drive, the team conducted for the first time a deep analysis, for the first time, that included a thorough look at signifiers and presented a psychoanalysis of the two brands’ identities. We looked at the identities of the banks and how whether their content reflected domineering, dogmatic, didactive, or even histrionic characters.

We applied our own methodology in analysing the data. Consult Upgrade methodology is a set of unique innovative data processes in which we apply quantitative and qualitative analyses technique to the aggregated data, informed and guided by a custom-made pragmatic, linguistic and psycholinguistic coding framework. We look at what the language collected can tell us about the sentiments of content writers, their personal traits, the drives behind their behaviour, and we look at key themes & word frequencies through our bespoke AI powered coding system designed for this particular research.

- At Consult Upgrade, we provide a complete set of solutions, analyses, insights, recommendations, contents, and training of your organisation to help you achieve your business and strategic targets. Whether it is a matter of survival, sustaining business, or even growth, Consult Upgrade is ready to partner you in your journey to success.

Click Here to Know More

THE FINDINGS: BRAND PSYCHOSIS…?

Content analysis of both brands indicated a strong histrionic character, capped with exaggeration, as what most brands fall into in their content creation online, however, this is capped with a lack of decisiveness and behvaiour control, especially on social media. For the UAE Bank A, an anxious, angry, domineering, dogmatic, and sometimes rather dramatic character is dominating their content. This was also accompanied with a striking lack of decisiveness and inability to control behaviour and emotions. While it is classic for banks, it was also quite clear that UAE Bank A was avoiding commitment in their social media and website’s content.

UAE Bank B was rather more sane (in language sense) showing better control over emotions, but still presented audience with histrionic dogmatic, and avoiding commitment voice.

THE FINDINGS: PSYCHO DRIVE

The lingu-psychosis of the UAE Bank A continued, as expected, to show in further analyses. Behaviour drive’s score were significantly lower than Bank B, especially when it comes to Social Media content. Reward and affiliation drives were significantly low. UAE Bank B fared a little better in website’s content, however, social media’s content also failed the bank to present and show proper behaviour drives.

THE FINDINGS: ANTI-SOCIAL SOCIAL MEDIA

With relative positive sentiments and emotions emerging from both banks’ websites, both let their audience down when their social media content. A shocking 30-41% of negative sentiments for both reflected in their social media content (compared to 14-32% negative sentiments of website’s content). The dominating “Fear” and “Sadness” sentiments coupled with a drop in “Love” and “Happiness” expressed in content.

THE FINDINGS: OBSESSSIVE COMPULSIVE

It was not all bad news for UAE Bank A as personality traits analysis showed better scores that its counterpart when it comes to organized, intellectual and cautious traits. However, UAE Bank B trumped Bank A in almost all other traits, especially in assertiveness, cooperative, trusting and friendly traits.

CONCLUSION: REACTIVENESS TAKING BANKS NOWHERE!

After examining the content of the top 2 UAE Banks, we have shown that content is actually reflecting little or no flexibility in reflecting adaptation to the current critical period Banking sector is undergoing at the moment. With the challenges mentioned above, one could see there are no indicators that the banks of the study are working on the critical shifts and transformation mentioned above. Profit is still the main motivator and engine that drives behaviour, hence content, to neglect all other aspects. Take “Loyalty” for example, it was one of the lowest drives and traits spotted in the content. How would brands undergo transformation without genuinely examine and transform the language they communicate with their most important element in their ecosystems: human stakeholders?

Consult Upgrade provide an in-depth linguistic and psychological analysis by harnessing and decoding the language used whether in social media, website, newsletters, campaigns, or any other medium. We know that one of the keys to a healthy business, is an understanding how language works while manipulating it to yield and return profit, and to achieve your business targets.

For full report and data contact us at Consult Upgrade or if you would like to have insights on your market, brand, marketing campaigns or your clients. At Consult Upgrade, we help you by:

– Collecting critical data about your content, clients, market, competition, and brand

– Delivering analyses, recommendations, and training on how to improve your campaigns, content, and brand outlook

– Auditing, designing, and developing new content to help you achieve your goals and targets

References:

Future of banking business models. (2021, November 9). Accenture | Let there be change. https://www.accenture.com/ae-en/insights/banking/future-banking-business-models

Higher value, lower risk: ESG finance moves to the banking mainstream. (2020, November 17). Bain. https://www.bain.com/insights/esg-finance-moves-to-the-banking-mainstream/

UAE banking sector 2021 outlook–a long recovery road ahead | S&P global ratings. (n.d.). Accelerating Progress | S&P Global. https://www.spglobal.com/ratings/en/research/pdf-articles/210126-slides-uae-banking-sector-2021-outlook-a-long-recovery-road-ahead-100048588

Comments are closed