RETELLING THE RETAIL TALE!

Retelling the Retail Tale: How UAE Retail’s loyalty is a simple matter of tongue twisting!

Almost a year to the day, COVID-19 pandemic hit the world hard and created a frantic chaos on how to deal with such catastrophe. Economies & markets suffered hugely with restrictions, guidelines, and safety measures imposed by governing authorities to control the spread of the pandemic. Yet, the bigger economic challenge was not the lockdown or quarantine rules, but it was merely the consumer: the change in habits and behaviours that impacted everything! This insight sheds light on the Retail market in UAE and how the content of major retail companies in UAE accommodated and adapted the COVID-19 pandemic and whether their content helped strengthening their brand loyalty or not.

UAE Retail Sector: Challenges yet to be overcome!

Retail sector, globally, was hit with drastic changes in supply and demand informed by supply chain related restrictions, but was mainly affected by a change in needs and preferences of customers. These changes manifested themselves in the following facets:

- A huge change in customers’ shopping behaviour & habits: Due to markets’ volatility and price awareness, people are spending less on non-essential non-food items (PWC 2020). This was a logical result of COVID-19 impact on our life. With 62% of people suffered a decrease in income, a majority of people are thinking more carefully about their spending including postponement of purchase of big-ticket items (Ahmed 2020).

- A shift towards online shopping at the expense of offline one: with around 35% of people are moving to purchase online what they used to buy in stores. With governments imposing lockdown and restrictions to respond to 2-3 waves of COVID-19 spread, some brands saw 80%, 100%, and even 200% increase in online orders over the past year (oliverwyman 2021).

- Brand loyalty is at a higher risk: With the above changes, customers and client are inclined to seek outlets that fit the new situation imposed by the pandemic at the expense of brand loyalty as around 30% of clients think that their brand choice will change (KPMG 2021). Retailers are facing a big challenge maintaining, let alone expanding, their brand loyalists. With the emergence of health concerns, people are more likely to be loyal to brands that nurture and prioritise clients’ safety & well-being (PWC 2020).

So how did the retail sector in UAE respond or adapt to these changes? Consult Upgrade conducted a research to understand the manner retail major players perceive, respond, and accommodate these changes in clients & customers’ economic DNA.

METHODOLOGY

For this analysis, we looked at the social media content of 4 major retail brands, hypermarket chains to be specific, in UAE. Two of which are well-know international brands, one public supermarkets chain, and one major regional hypermarket brand. We collected the data that cover pre and during pandemic in order to compare the adaptations the brands put in place to face this sudden change. Consult Upgrade collected, compiled, and analysed over 300,000 words! We applied our own methodology in analysing the data. Consult Upgrade methodology is a set of unique innovative data processes in which we apply quantitative and qualitative analyses technique to the aggregated data, informed and guided by a custom-made pragmatic, linguistic and psycholinguistic coding framework. We look at what language collected can tell us about the sentiments of writers, their personal traits, the drives behind their behaviour, and we look at key themes & word frequencies through our bespoke coding system designed for this particular research.

The findings came with quite interesting results.

THE FINDINGS: Phantom of The Retail

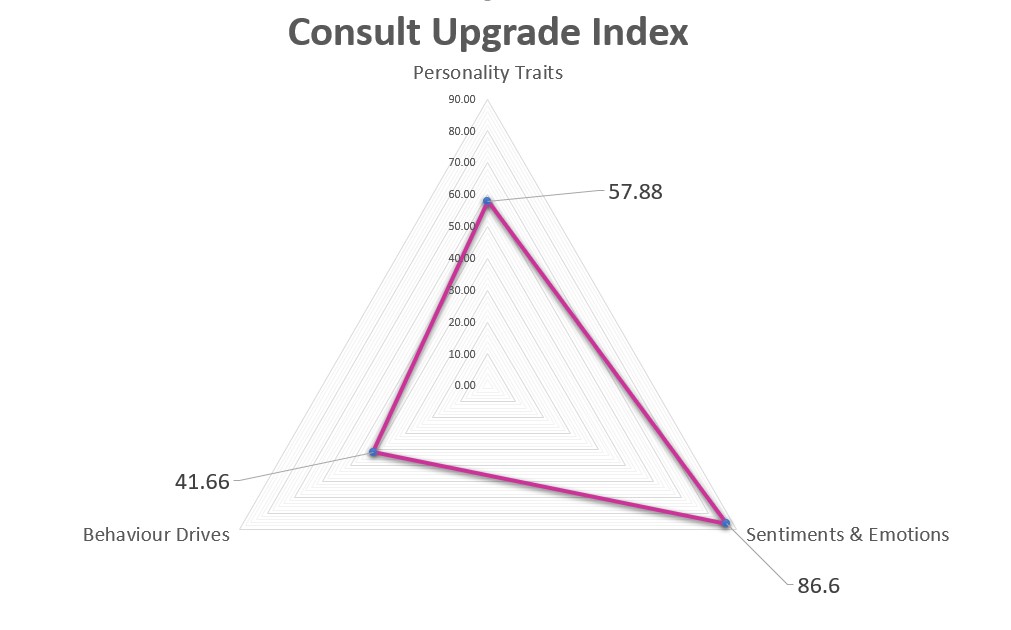

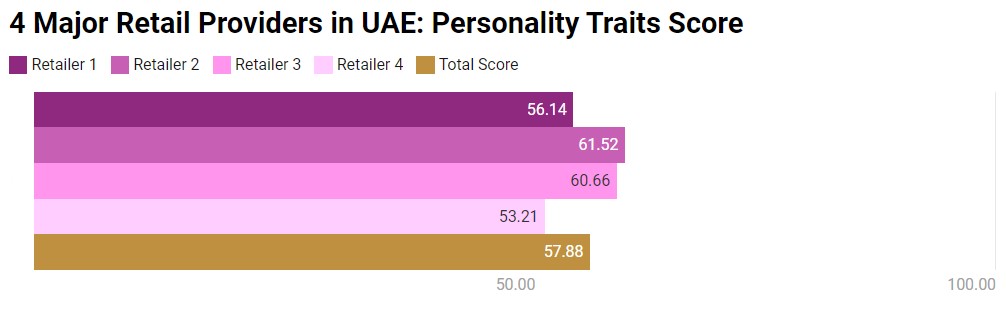

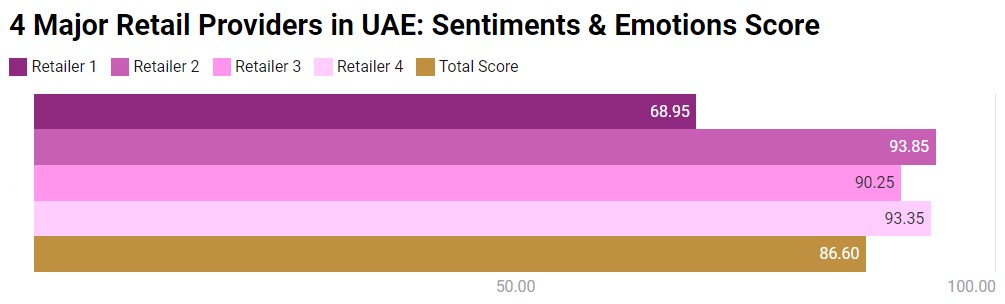

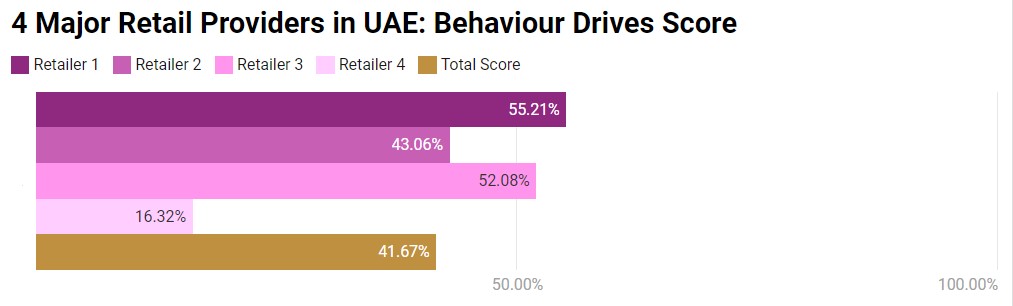

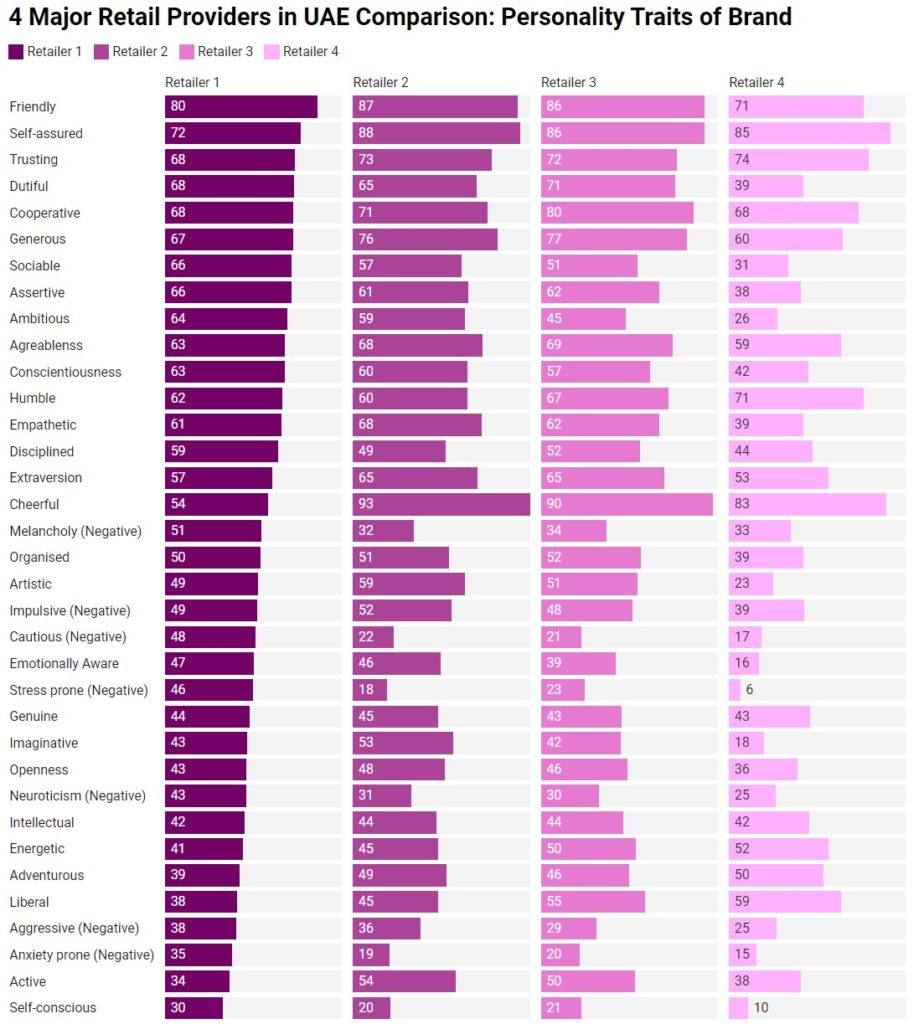

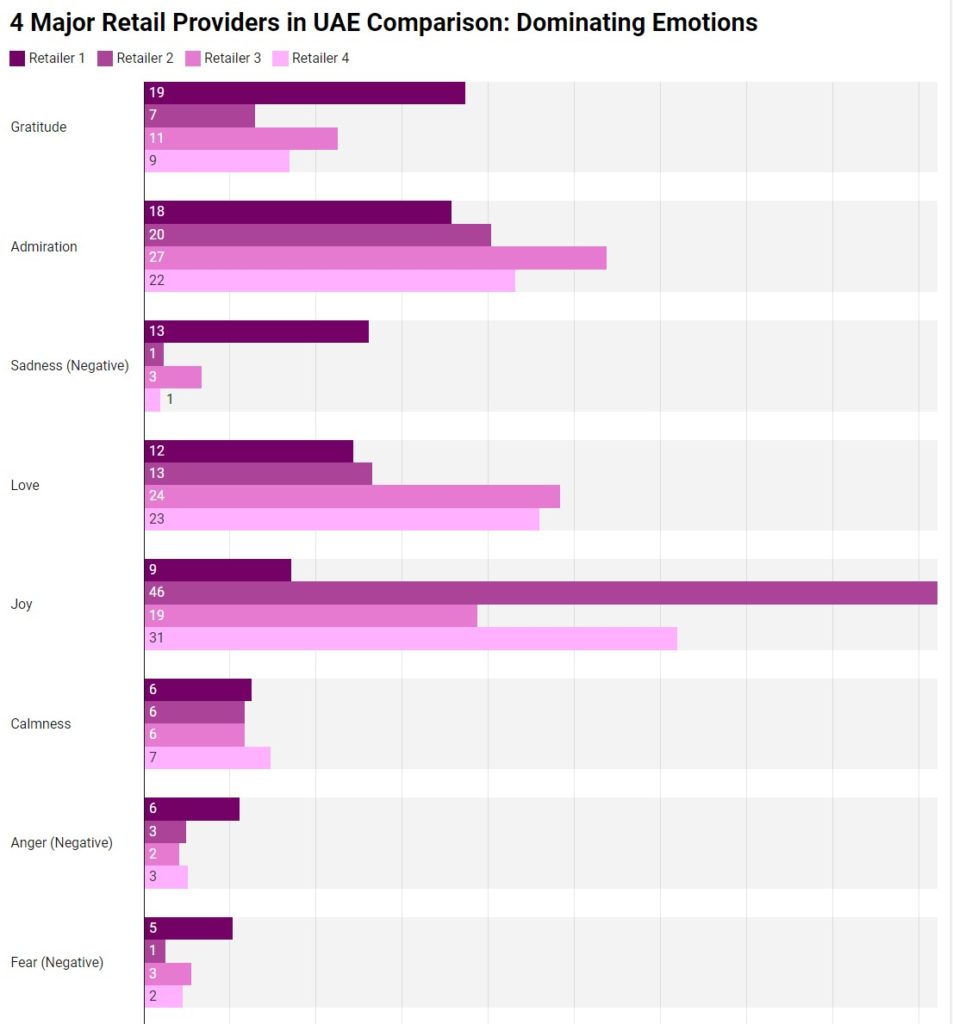

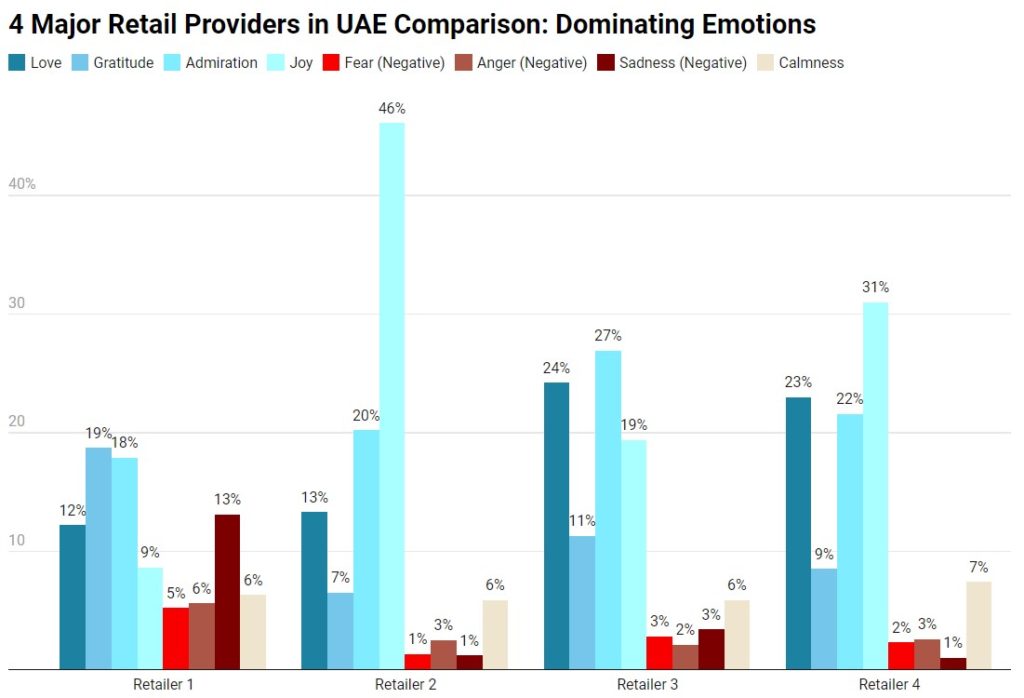

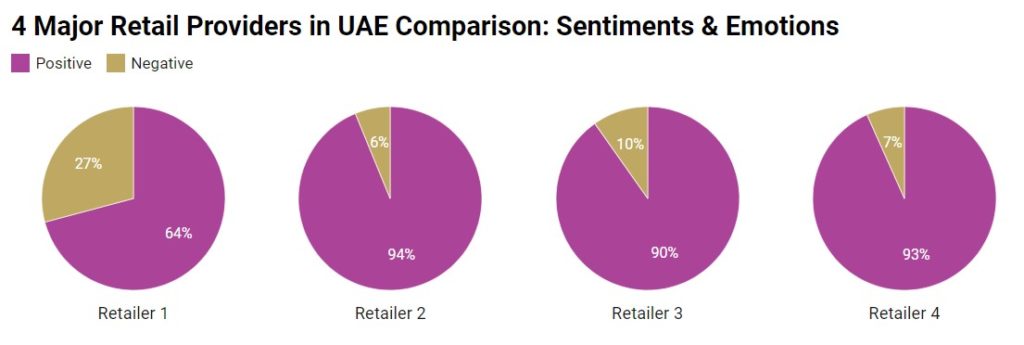

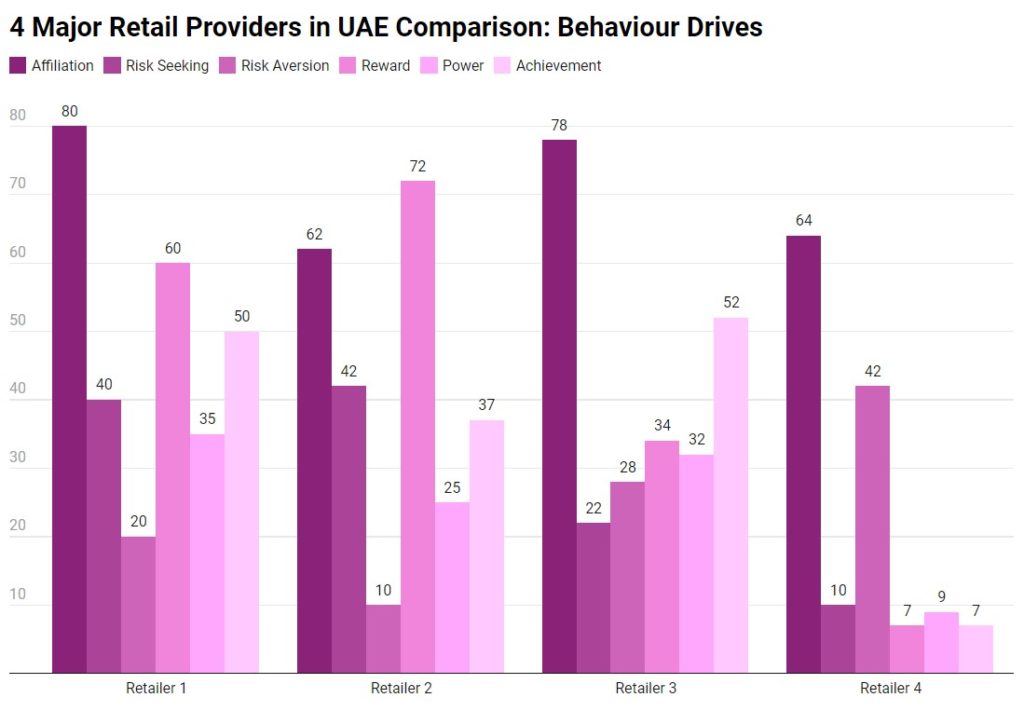

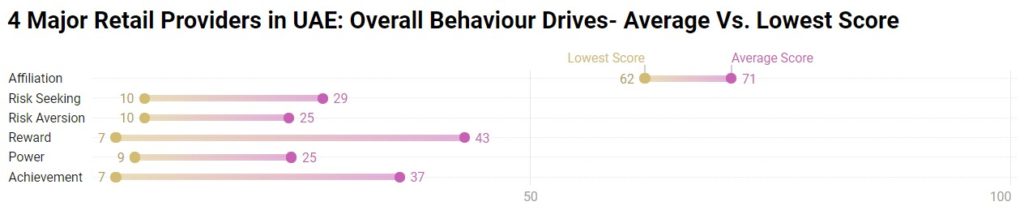

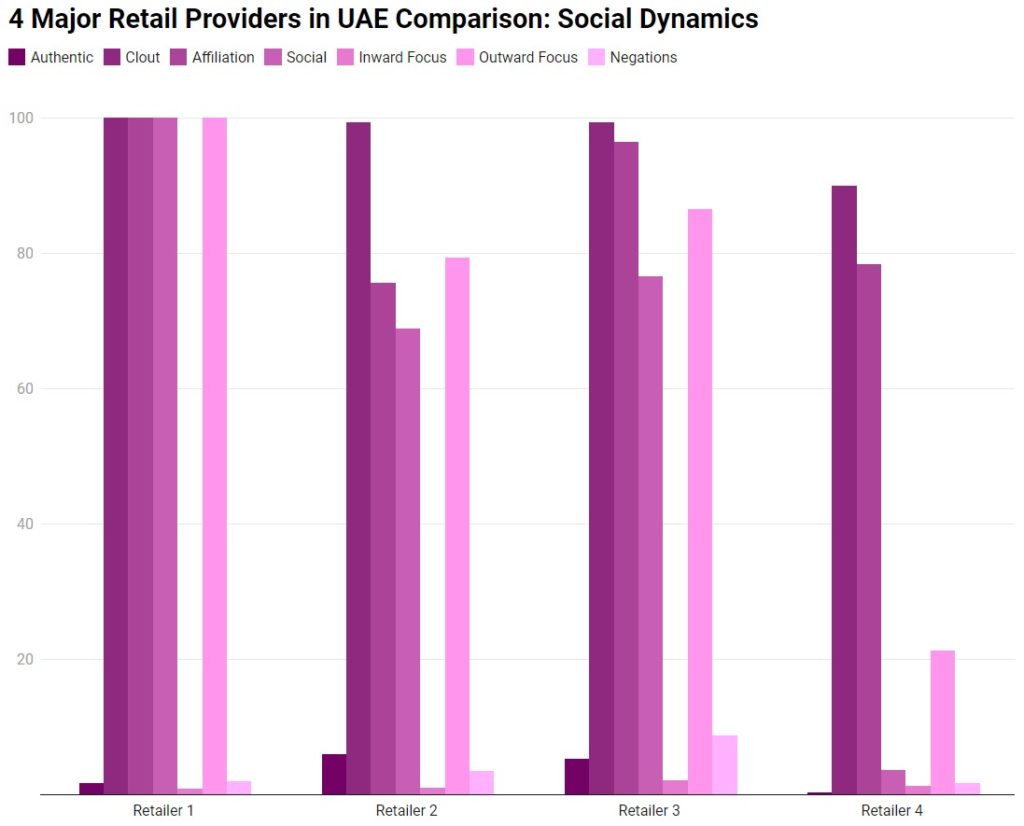

When conducting the research analysis, Consult Upgrade found that most 4 Retailers show enough positive sentiments in their content, with the exception of Retailer 1 which expressed a surprising 27% negative sentiments and emotions (see below for details on Retailers’ comparisons). The four Retailers scored a good 86.6 in our Emotions and Sentiments’ index. However, the 4 Retailers showed a flat personality scores with an overall score of 57.8 on Consult Upgrade’s Personality index. This low score is a direct result of Retailers expressing contrasting personal traits in their content posted on social media. The major culprits of such low score were melancholy, neuroticism, and even aggressiveness expressed in content. Yet the lowest score in our indices was the behaviour drives score with 41.67. With the “Affiliation” drive taking the pole position amongst behaviour drives, “Achievement” was not as evident drive with fluctuating low scores between the four Retailers.

THE FINDINGS: Existential Crisis

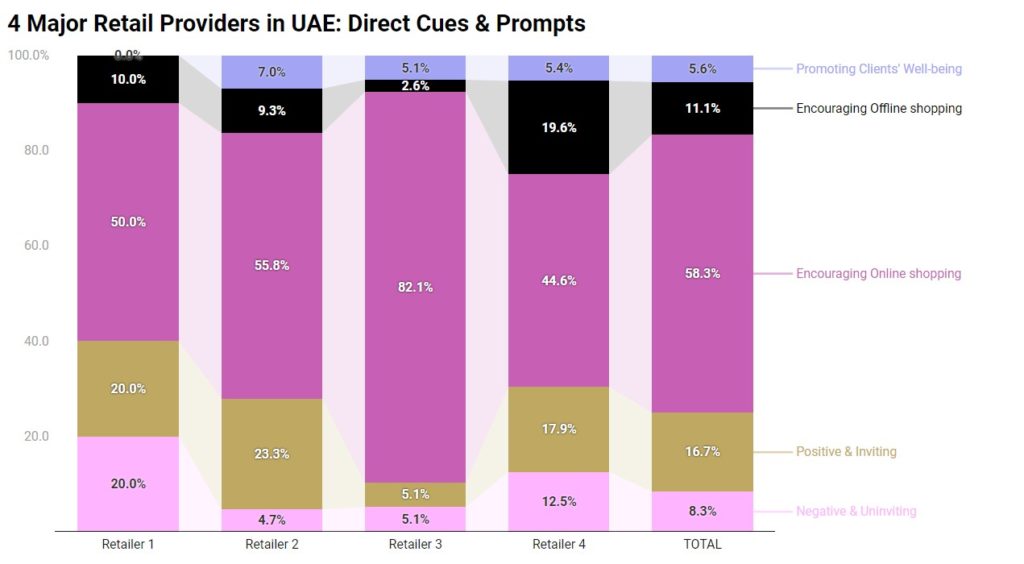

Content of the four major Retailers in UAE found a degree of ambiguity and inconsistency in relation to the purpose of content. Consult Upgrade applied advanced coding system to detect five distinct types of cues, prompts, and themes of content: encouraging online shopping, encouraging offline shopping, positive and inviting, negative and uninviting, and promotion of audience’s well-being. All Retailers came short on promoting the safety and well-being of clients, especially during the pandemic; and in addition to the alarming percentage of negative and uninviting cues found in Retailer 1, two Retailers were even encouraging offline shopping during the pandemic!

THE FINDINGS: Retailers’ Face-Off

When we put UAE’s four major Retailers in comparison, it is apparent that each Retailer maintains a distinct character in their social media presence. Retailer 1 was probably with the most contradicting sentiments and personality traits with an astounding 25% of content reflecting negative emotions (anger, sadness, and fear).

Retailer 2 was the most joyous and cheerful of the lot, however, it showed lack of gratitude to clients and deflated social dynamics (affiliation, social, and outward focus).

Retailer 3 was probably the most balanced of the four Retailers, yet when it comes to the cues and prompts, it came the least Retailer with positive and inviting cues and prompts in their content with 5.1% compared to and average of 20% for other Retailers.

Retailer 4 seemed to tick all the boxes: good sentiments score of 93.35, an average personality score of 53.21 with being the Retailers with the least scores in negative personality traits. However, when it comes to behaviour drives, it came flat with a low score of 16.32 compared to the closes Retailer with 43.06 score!

- At Consult Upgrade, we provide a complete set of solutions , analyses, insights, recommendations, contents, and training of your organisation to help you achieve your business and strategic targets. Whether it is a matter of survival, sustaining business, or even growth, Consult Upgrade is ready to partner you in your journey to success.

Click Here to Know More

WHAT’S NEXT FOR RETAIL SECTOR IN UAE?

In this everchanging economic landscape, adapting is key to survival, while leading and shaping the market is critical to growth! Retailers in UAE are faced with a number of challenges:

- Understanding the changing needs, behaviours, and habits of their clients

- Creating an entertaining personalised online shopping experience (Monteton and Schoemann 2020)

- Looking after their client base by paying more attention to their well-being and mental health

- Creating signature moments & nurturing emotional interactions to build and expand loyalty and lasting relations (Capgemini 2019)

For full report and data contact us at Consult Upgrade or if you would like to have insights on your market, brand, marketing campaigns or your clients. At Consult Upgrade, we help you by:

– Collecting critical data about your content, clients, market, competition, and brand

– Delivering analyses, recommendations, and training on how to improve your campaigns, content, and brand outlook

– Auditing, designing, and developing new content to help you achieve your goals and targets

References:

CapGemini, 2019, One happy customer, viewed 25 March 2021, https://www.capgemini.com/

KPMG, 2021, Consumers and the new reality: Consumer & Retail, viewed 25 March 2021, http://home.kpmg

Monteton, V & Schoemann, S 2020, Never a dull moment: capture consumers with a superior online experience, viewed 25 March 2021, https://www.kearney.com/

Oliverwyman, 2021, CHANGING CONSUMERS, NEW OPPORTUNITIES, viewed 25 March 2021, https://www.oliverwyman.com/

PWC, 2020, The consumer transformed, page 4, 17, viewed 25 March 2021, https://www.pwc.com

Reda, A 2020, Future Consumer Index: is e-commerce creating digital disruption for MENA consumers?, viewed 25 March 2021, http://www.ey.com

Comments are closed